A Bumpy Road To The Inflation Target

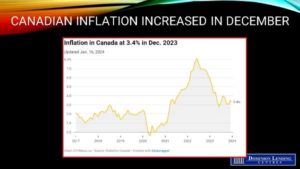

Canada’s headline inflation number for December ’23 moved up three bps to 3.4%, as expected, as gasoline prices didn’t fall as fast as a year ago. These so-called base effects were also evident in the earlier US inflation data for the same month.

Additional acceleration came from airfares, fuel oil, passenger vehicles and rent. Prices for food purchased from stores rose 4.7% yearly in December, matching the increase in November (+4.7%). Moderating the acceleration in the all-items CPI were lower prices for travel tours.

A Bumpy Road To The Inflation Target

On a monthly basis, the CPI fell 0.3% in December after a 0.1% gain in November. Lower month-over-month price movements for travel tours (-18.2%) and gasoline (-4.4%) contributed to the monthly decline. The CPI rose 0.3% in December on a seasonally adjusted monthly basis.

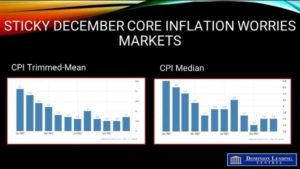

Two key yearly inflation measures that are tracked closely by the Bank of Canada and filter out components with more volatile price fluctuations — the so-called trim and median core rates — increased, averaging 3.65%, from an upwardly revised 3.55% a month earlier. That’s faster than the 3.35% pace expected by economists. The trim rate rose due to the movements of rent and passenger vehicle prices.

Another important indicator, a three-month moving average of underlying price pressures, rose to an annualized pace of 3.63% in December from 2.94% in November, according to Bloomberg calculations. The Bank of Canada follows this metric closely because it reveals shorter-term inflation trends.

A Bumpy Road To The Inflation Target

According to Bloomberg News, following the release of today’s CPI data, “the yield on two-year Canadian government bonds rose about four basis points to 3.857%…Traders in overnight swaps pushed back bets on when the Bank of Canada will start cutting rates to July, from as early as April before the release.”

Bottom Line

This is the last major data release before the Bank of Canada meets again on January 24th. I concur with the widely held view that the rate pause will continue at the next meeting despite evidence that the economy is slowing. Governor Tiff Macklem will err on the side of caution before beginning to cut overnight rates. The last reading on wages showed a 5.4% y/y rise, and yesterday’s housing release showed a bump in sales. Macklem and Co. will keep their powder dry until they see an all-clear signal that core inflation is sustainably below 3%.

A Bumpy Road To The Inflation Target

Questions? Comments? Reach out:

📲 705-606-2727

📧 jmuir@dominionlending.ca; jon@jonmuirmortgages.ca

🌎 https://g.page/r/CXZmhubK7M5xEAE

Dominion Lending Centers – The Mortgage Source. Independently Owned and Operated.

License #: 10145

92 Caplan Ave #609, Barrie, ON L4N 9J2

A Bumpy Road To The Inflation Target